TAX CORNER - CORPORATE INCOME TAX (CIT)

Now the time is being close to the end of year 2023. This chapter is to talk about the year end book closing procedure in relation to annual income tax calculation. According to International Accounting S tandards (IAS) that have been developed to be International Financial Reporting Standards (IFRS), Thailand has adopted IFRS to be applied for Thai’s own standards by Federation of Accounting Professions. As a result, accounting practice in Thailand must be complied with Thai Financial Reporting Standard (TFRS). The financial reporting structure shall be as follows:

REVENUE BAHT

Sales Income xx,xxx.xx (1)

Cost of Sales xx,xxx.xx (2)

Gross Profit xx,xxx.xx (1)-(2) (A)

Other Income x,xxx.xx (B)

TOTAL REVENUE xx,xxx.xx (A) + (B)

EXPENSES Selling

Expenses x,xxx.xx (3)

Administrative Expenses x,xxx.xx (4)

TOTAL EXPENSES xx,xxx.xx (3)+(4) (C)

Net Profit Before Financial Cost and Income Tax xxx.xx (A) + (B) – (C)

Less : Financial Cost xx.xx

Net Profit Before Income Tax x,xxx.xx

RELATION BETWEEN ACCOUNTING AND TAXATION DATA

There are some items of income and expenses generated by accounting standard practice and taxation figures that need to be reconciled as follows: Sales Income per bookkeeping must be in line with total sales of the period declared in monthly VAT reports in total. Tax allowable expenses : Actual Expenses incurred that are less than taxable allowance such as – Depreciation of fixed assets that are less taxable allowance. (The related detail of condition shall be presented in the next issue) Tax disallowable expenses such as – Depreciation exceeded the limit of taxable expenses, public charity and education activity supporting expenses more than 2% of net profit before income tax and also customer entertaining expense exceeding a certain limit of taxable expenses. By this way income tax calculation shall be Net profit of the period + Tax allowable expenses – Tax disallowable expenses = Taxable profit for income tax calculation. There are still more types of tax allowable and disallowable expenses and income that is tax exemption to be presented in the next chapter. CORPORATE INCOME TAX RATE: *SME (Corporation with Capital not more than 5 Million Baht with Assets and Income not more than 30 million Baht. Net Profit of not more than Baht 300,000 is exempt. Net Profit at Baht 300,001 to 3,000,000 Income Tax is 15% Net Profit more than Baht 3,000,000 Income Tax is 20% *Non-SME business income tax is only one rate = 20% of net taxable profit. The presentation has been made in brief and will be more informative in the next issue. If you have any questions you may contact us at Siriyothin Accounting and Law Office.

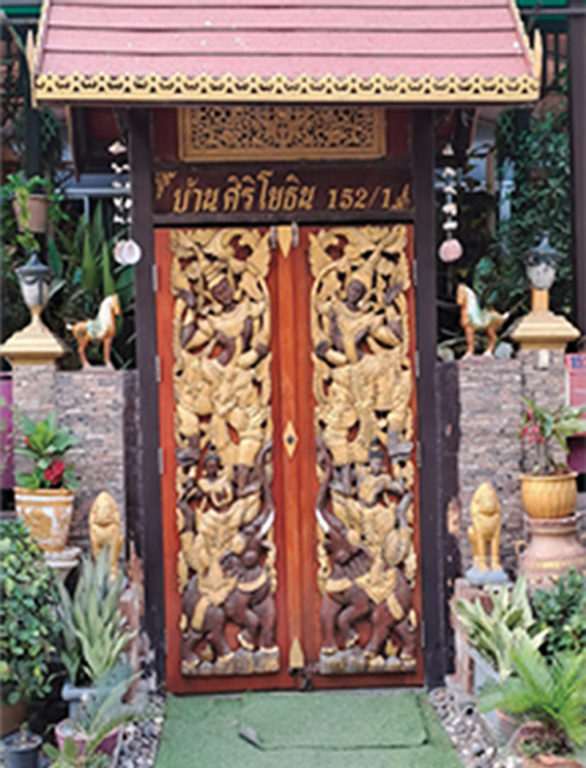

email: [email protected]