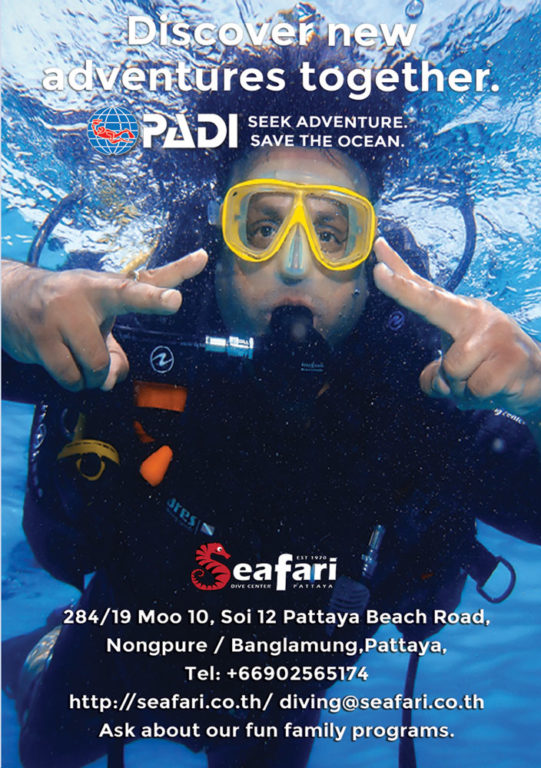

Experience the thrill of breathing underwater for the first time with the PADI Discover Scuba Diving program, the world’s leading try scuba diving program.

Mae Pim is a delightful and unspoilt beachside area in Rayong. Sometimes overlooked by visitors to this neighbouring province to Pattaya because of the popularity of the island of Koh Samet for their weekend getaway.

The founders of Gustaf Real Estate opened their business in Pattaya in 2020 just as the world was going into the full force of the Covid pandemic.

In a new series of articles we look at what is here, or literally on our doorstep, that we have yet to see or do.

I was recently lucky enough to receive an invitation to a James Bond-themed event hosted by Violette Gauthier and The Pattaya Gastronomic Society , to be held at the Intercontinental Pattaya Resort.

The snooker event of the year, the world championship, starts on the 20th of the month and is again being played at the Crucible Theatre in Sheffield.

We have a fantastic month of sport for April starting with the Champions League quarter finals on the 9th and 10th of the month.

PADI® Open Water Diver is the first scuba certification level. Tought by one of the Seafari, highly-trained PADI Instructors. We will teach you how to scuba dive in a relaxed, supportive learning environment.

As educators, we understand that education goes beyond the confines of the classroom.

Anyone who has lived in the UK and been for a bit of a “session” or a pub crawl with mates, knows about the type of food you absolutely crave at the end of such an evening.

For us, the main event consisted of crab pasta which was pleasantly spicy with clams and saffron and the star of our show: Phad Thai Goong Mang Gon!

First things first. March means Cheltenham. It starts a bit earlier this year, running from the 12th until the 15th of the month and the timings are great for the local horse racing fans, as the first race each day goes off at 1.30, giving us four great evenings of entertainment.

In a new series of articles we look at what is here, or literally on our doorstep, that we have yet to do or see. Last month we decided that a visit to Angkor Wat was an absolute must. If you didn’t read this in our February magazine then it’s still available to view online at pattayatrader.com.

Thailand’s education system is rich in cultural nuances and traditions that may differ from those in other countries.

In the pursuit of creating a haven, many homeowners overlook the importance of exterior aesthetics. Your home’s exterior is the first impression visitors and passersby have, making it a crucial element in establishing the overall ambiance.

Thailand’s education system is rich in cultural nuances and traditions that may differ from those in other countries. For parents living in Pattaya, understanding the intricacies of the Thai education system is crucial for making informed decisions about their children’s education.

There’s something quite joyful about an American Diner. I have fond memories of the ones I visited during holidays in Florida.

With the investment going into the Eastern Economic Corridor and likely expansion of infrastructure reaching further down the Eastern Seaboard of Thailand, the province of Rayong is appealing as a place to settle in the long term for many people.

What is it about St Patrick’s Day that makes it so very popular? Certainly it is world-wide, the most popular of all the UK’s saints’ days and seems to have transcended its religious origins to be more of a celebration of everything Irish.

We’re more often than not in such a rush that we forget to go look for somewhere to relax and spend time.

Brexit pushed up the price of imported products, a key cost for all restaurants, and has made the hiring of skilled staff more difficult and expensive.

Looking to renovate your home this year? Here’s some inspiration for exterior design styles that will be popular in 2024.

In a new series of articles we look at what is here or literally on our doorstep that we have yet to do or see. To start, an absolute must: a visit to Angkor Wat.

Esther Kaufmann is known to many for her years as a travel agent and advisor at My Office 4 Travel. Back in 2005 the office was located on Walking Street and then in 2007 it moved to Jomtien Soi 5, close to the busy immigration office.

The month starts with a bang for all rugby fans because the six nations is with us again. France and Ireland, both well fancied to win the recently played World Cup,

Pattaya, Thailand, 25 January 2024 — Pioneering the marine lifestyle in the Gulf of Thailand for more than 30 years

As the world continues to evolve, so do our travel preferences and aspirations. With the dawn of 2024, a fresh wave of travel trends is set to shape the way we explore the globe.

On our 4th Anniversary at Sun Sabella come to our big bash on the 17th of February.

Discover Pattaya tried a wonderful selection of Tex Mex delights laid on by the Sportsman.

As the world continues to evolve, so do our travel preferences and aspirations. With the dawn of 2024, a fresh wave of travel trends is set to shape the way we explore the globe.

Our team experienced a tremendously enjoyable and fashionable time in Bangkok, filled with smiles and delight.

Pattaya Prestige Properties founded 12 years ago and now with over 2,500 listings had an excellent position at the show.

It was a real gala event held at the stunning Four Seasons Hotel Bangkok.

Now is the time after decisions were made for in-home offices or cosy nooks for cocooning, to take your interior design to the next level.

Social gatherings can be a great way to meet new people, catch up with old friends, and have fun. However, it can be challenging to break the ice and get people to feel comfortable.

If you need help with anything to do with the repatriation of a sick or deceased loved one, you should absolutely call on the skill and patience of Dao and Jeff Mitchell and their team at Amar International Asia.

What makes Jewish Deli food so Delicious? Well, the affectionately termed Mrs Salty of London Beigel and Salt Beer Bar will proudly tell you it’s because it’s made with love.

Here in Pattaya wine dinners have grown in popularity over the past couple of years with many restaurants and suppliers promoting such events.

In the early naughties, the girl singers from my U.K. party band ‘Wild at Heart’ kept nagging me to write a Christmas song, something I had been trying to avoid my whole career.

Returning to my beloved London, I was dismayed to find the weather damp, cold and generally miserable. However, the West End shopping district still had plenty to uplift my spirits and as always the festive spirit was palpable.

Now the time is being close to the end of year 2023. This chapter is to talk about the year end book closing procedure in relation to annual income tax calculation.

Earlier this year Bert Elson BEM who is retiring as the British Honorary Consul of Chonburi had a small farewell event attended by H.E Mark Gooding OBE British Ambassador

The sporting calendar for 2024 has a host of top events lined up but the year is dominated by two of the greatest shows that sport can provide, the European football championships and the Summer Olympics.

The weather couldn’t have been better for the opening of another tremendous Tennis Championship at the Royal Cliff Hotel’s beautiful Fitz club.

Now on the water and ready for some fun, the Jeanneau Cap Camarat 10.5 CC has been designed as a real crossover boat, this 36-footer in GRP makes the most of convertible features to meet the needs of everyone from dedicated parents to die hard party animals.

In the ever-evolving landscape of education, the integration of Artificial Intelligence (AI) has become a transformative force that promises to reshape the way our children learn and grow.

As a friend of mine remarked the other day, “The InterContinental Pattaya Resort is just pure class”

For many months curious passersby have been wondering about the construction taking place next to Marco’s restaurant.

Are you mesmerised by the glamorous scenes in James Bond’s “GoldenEye” or the world-class Formula 1 race? I certainly am, which is why I went to Monaco.

The Foreign Business License (FBL) is a type of license necessary for foreign companies doing business in Thailand. The Foreign Business Act (FBA) regulates foreign business activities in Thailand.

If you’re thinking of buying a property in Pattaya in the near future, doing your own research and finding out as much as you can about the place you want to live in is obviously a good thing.

I have been wanting to interview Jack Lemvard for quite some time as he is definitely a local success story, born in Pattaya at the Memorial Hospital.

The approach to the International School Eastern Seaboard must be one of the most scenic in Thailand: nestled among the manicured fairways of Burapha Golf Club, the school has been an established name within the region since its inception in 1997.

In the ever-evolving landscape of education, parents are constantly seeking innovative methods to enhance their children’s learning experiences and boost academic achievements.

Lovell International School is an oasis of calm and learning in the heart of busy North Pattaya. I met with the Head of School, Ms. Karen Jones, to find out more about this hidden gem.

I’ve always loved South Korea. The land of the famous Hallyu wave – with its K-pop culture

Time has flown by and it will be nearly one year since my first visit to Rugby School Thailand.

What is the point of being by the sea if you don’t take time out to enjoy it?

Talking to many of our expert property agents here in Pattaya it seems that International buyers are now happier to converse in English than they once were.

The French Riviera, with its sun-kissed beaches, azure Mediterranean waters, and glamorous cities, has always been a magnet for travellers seeking relaxation and sophistication.

I feel fortunate to have been a part of the British Learning Centre’s journey. When I took over as the Deputy Head of School at the British Learning Centre: Pattaya, the school had already established a strong reputation for excellence

Peturday has everything you could possibly want for your pet and yourself as a devoted pet owner.

In the heart of Cha-am, amidst the lush landscape, lies the angler’s paradise – Jurassic Mountain Resort and Fishing Park.

The M8 is the new flagship of Prestige’s M-Line of multihull motor yachts and takes luxury real estate on the water to a new level.

What is it about Sunday that makes you want to celebrate with a great meal? Nostalgia for our mum’s Sunday roast? A need to mark the end of the weekend and prepare for the week ahead? A good old feed up before the diet starts Monday ?- as all diets do.

I don’t think that anybody can argue that the recently completed Women’s World Cup was anything other than a resounding success.

If you’re thinking of relocating to Thailand, the first name that springs to mind is inevitably Bangkok, one of the most famous cities on earth and visited by millions every year.

October the 24th is World Polio Day, an annual event that concentrates the minds of people all over the world to come together and help with the eradication of a terrible, disabling disease.

We are very lucky to live in Pattaya, as we are spoilt for choice when it comes to playing golf with 28 excellent golf clubs nearby.

Acting whilst still at school and around 11/12 years old, I found I was really interested in using my imagination, pretending and immersing myself in acting.

As the long holiday begins to wane, a new academic year dawns upon us. For parents and children alike, this is a time of anticipation, excitement, and perhaps a touch of trepidation.

Sharples traditional fish and chips can now be found not only in Soi New Plaza but also on Thappraya Road, Jomtien.

We went to discover what was on offer at the beautiful Andaz, Pattaya, Jomtien Beach Resort. Their “Off the Grill” Sunday lunch buffet at Village Butcher certainly looked fabulous.

The Tamar Center was founded in 1999. It’s aim to provide education, vocational training and job opportunities for girls wishing to leave bars.

Discover Pattaya was delighted to review the new Romsai Brasserie on Beach Road. Brought to you by the same ownership as Cafe La Plage

Phuket is currently home to a growing collection of ‘classic’ yachts, some for charter, some for sale, but all with a vintage sense of style and a rich heritage.

It would seem that Mooltripakdee International School is the best kept educational secret in the region. Tucked away among the tranquil countryside east of Pattaya,

Discover Pattaya went to the latest wine dinner hosted by Renaissance Pattaya Resort & Spa. This time we decided not just to attend the dinner

If you’re considering retiring to Thailand, you will be of an age where your health and the care available in the kingdom will be one of the most important things that you have to consider

Discover Motoring is going to take a look at some of the new model vehicles that are, or will be, on sale in Thailand very soon.

Innovation, adaptability and credibility are valuable qualities of any educational institution and Regents International School Pattaya has shown their miraculous growth and progress over the past 25+ years.

Nestled within the heart of the ever-popular Lake Mabprachan area, Magic Cafe has swiftly become the talk of the town.

Just a few minutes away from Pattaya and Jomtien, on the shores of Lake Chak Nok. A unique green oasis extending over 2,000m2 is bordered by a river and natural pond.

The Highlight of our Phnom Penh trip was a sunset boat ride. We really recommend taking a boat on the Mekong River and the price is so reasonable, especially if you don’t book but just show up.

Following earlier festivals along the Amazon River and in the Sahara Desert, the latest edition of Immersion was held in Raja Ampat, which provided a spectacular backdrop for an alluring cocktail of dancing and diving, meditation and music.

Millions of men and women over the age of 40 struggle to shed their excess pounds, despite trying every type of diet and working out every week.

Over 500 LGBTQIAN+ joined a Parade of Rainbow Flags to symbolize equality and reflect Central World as a space that embraces diversity. Also, a space that accepts all differences and promotes equality.

The British Learning Centre is thrilled to announce the opening of its second centre, in Bang Kapi, Bangkok.

Rugby School Thailand’s rise to prominence has been nothing short of meteoric.

London has been named the best city brand in the world, followed by New York and Paris, by the inaugural Brand Finance City Index.

This charming spot has friendly staff clad in lovely colourful uniforms ready to serve you an amazing array of food and beverages.

The Eastern Seaboard Business Dinner is a monthly event and It brings together business leaders and professionals from various industries to network and exchange views,

I was duly impressed at how the developers kept the Grade II listed exterior.

Document legalization is a process that confirms the authenticity of a document, ensuring it is genuine and authentic.

PART 1 – Story and pictures by Jason Rupp and Carla Marie Rupp

When Rory McIlroy won the fourth of his major titles in the US PGA championship at Valhalla in Kentucky in 2014, the great Jack Nicklaus said “Rory is an unbelievable talent.

As it celebrates its 10th anniversary, Asiamarine has added Swan and Silent-Yachts to a portfolio of brands including Galeon, Bali and Nimbus, while growing its regional network of Fraser superyacht brokers from Hong Kong to Singapore and Thailand.

Discover Pattaya went along to the Sportsman for their “All you can Eat Pizza, Pasta and Salad Buffet” to find out what you get for the price of 249 Baht.

In June 2023, a self-funded team of 12 women, under the banner of HER Planet Earth, will embark on a unique triple-challenge, which will incorporate mountain climbing

Nestled within the rolling countryside of Eastern Thailand, Rugby School Thailand began with a vision to bring genuine British independent boarding school education to Thailand.

Selecting the right international school for your child can be a daunting task, especially if you are relocating to Pattaya. With a plethora of options available, parents may feel overwhelmed and unsure of where to start.